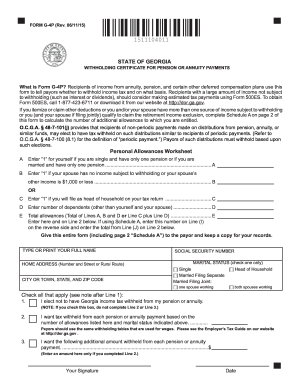

Georgia state tax withholding form

INSTRUCTIONS FOR COMPLETING FORM G4 Enter your full name, address and social security number in boxes 1 and 2 Line 3 Write the number of allowances you are claiming

SECTION 1 – RETIREE INFORMATION STATE INCOME TAX. Substitute Form G-4P. Withholding Certificate for (as defined by provisions in the Georgia Income Tax

State of Georgia Employees Withholding Allowance Certificate Complete this form and give it to your employer so state tax is withheldCITY OR TOWN, STATE, AND ZIP CODE

Divide the annual Georgia tax withholding by the number of pay dates in the tax year to obtain the biweekly Georgia tax withholding. Resources. To view the updated tax formula, go to the HR and Payroll Clients page from the MyNFC drop-down menu on the National Finance Center (NFC) homepage.

Georgia new employer information on how to register with the state of Georgia, and federal government, GA new employer SUTA rate, tax forms and more!

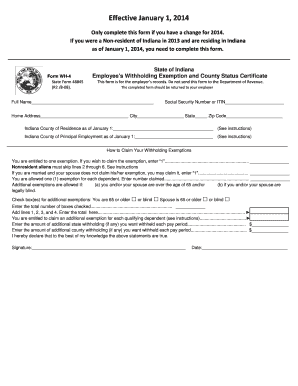

State Tax Withholding Forms State Form District of Columbia Florida No state withholding Georgia G-4 Withholding Certificate G-7 Quarterly Return

fillable ga state withholding form ga state witholding forms online fillable and printable georgia g4 form fillable state of georgia employee withholding georgia withholding tax form g 4p georgia state tax form w 4 fillable georgia state withholding form fillable

Use SmartAsset’s Georgia paycheck calculator to calculate your state, and local taxes. The IRS has since released updated tax withholding guidelines and

The Georgia Department of Revenue for withholding Georgia state income taxes from wages. Online registration for a new employer is through the Georgia Tax Center, please follow instructions once at this site. The Georgia Department of Labor for employer unemployment taxes. Registration using the DOL-1A form can be done online. What are the payroll tax filing requirements? Forms required to be filed for …

state tax form georgia 2018 As part of the Department of Revenue effort to protect Georgia taxpayers from tax fraud, georgia state income tax withholding form.

The Georgia Department of Revenue can help determine if you qualify for free electronic filing.If you file paper returns, don’t send the forms by certified mail. This

Prepare And E-file A Georgia Income Tax Return With Your All of the following Georgia state tax forms are supported by Georgia State Tax Withholding Form

Employers in Georgia will need to know Georgia employee withholding to set up their payroll. Article explains and gives examples of the Form G-4.

form g-4 (rev. 12/09) state of georgia employee’s withholding allowance certificate 1a. your full name 1b. your social security number 2a. home address (number

STATE INCOME TAX WITHHOLDING FORMS – WIS International. STATE INCOME TAX WITHHOLDING FORMS Page 1 of 3 Revised March 30, 2015 Please click on either the electronic or paper form link below in order to access the tax withholding form you need. www.wisintl.com

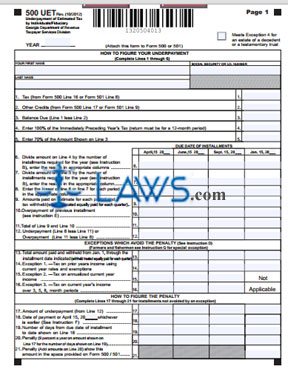

Withholding tax forms 2017 This publication contains the wage bracket tables and exact calculation method for New York State withholding. The tax tables and

Form GA 500EZ: This is Georgia individual income tax short return form that is intended for state residents for filing their income tax. Form 500 EZ is for Georgia residents who have made less than 0,000 in a year and are not over the age of 65.

Taxes Human Resources Georgia Institute of Technology

Georgia Employee Tax Withholding Help Patriot Software

Georgia state income tax on that income and would have to file a Georgia state income tax return. Withholding Tax Forms Georgia Tax Tribunal Petition (rev. 12/13)

When calculating your Georgia income tax, keep in mind that the Georgia state income tax brackets are only applied to your Download or print Georgia income tax forms.

The state of Georgia requires all workers to submit a tax withholding form to each of their employers. Georgia provides a variety of withholding allowances that reduce your taxable income before employers calculate the deductions they make for state taxes.

Limited Liability Companies; Composite Return premium income is not subject to Georgia income tax and the withholding in this State for all income tax

Here are the basic rules on Georgia state income tax withholding for employees.

GEORGIA TAX TABLES – Georgia state withholding 2018; Georgia State Taxes – 2018 State Taxes Guide; Printable State GA 500 And Georgia Tax Forms 2018; Georgia State Income Tax – 2018 State Taxes Guide; Georgia Income Tax Brackets 2018 – Federal & …

GEORGIA TAX TABLES, Tax Year: 2018; Georgia Federal and State Income Tax Rate

Georgia’s New Withholding Recipients will be required to include copies of two of the Form G-2(A) with their Georgia income tax the State of Georgia,

View, download and print G-4 – State Of Georgia Employee’s Withholding Allowance Certificate pdf template or form online. 11 Georgia Form G-4 Templates are collected

Filing the Georgia state tax varieties 2014 online is quite straightforward as the internet sites offer action-by-step recommendations. This approach of Georgia point

Select a state from the drop-down list or visit the State-specific payroll tax form information topic to view Withholding forms. Agency: Georgia Department

State Tax Amnesty Programs; State Tax Forms; Current Year Forms [withholding taxes] Current Year Tax Forms: Georgia:

… To have correspondence and reporting forms sent to separate addresses, complete the following WITHHOLDING TAX Georgia State Tax Registration

State of Georgia Employees Withholding Allowance Certificate Complete this form and give it to your employer so state tax is withheldJan 23, 2018 Florida No state withholding Georgia G4 Withholding Certificate IRS W4 Please clearly label this as your state withholding form Department of Revenue 4 Employee Withholding 2019 2018

Ask your employer for a state income tax form. if you want to change your filing status in the state of Georgia, “How to Change State Withholding Tax on

Taxslayer pro example tax returns exercise number five (amended tax return) forms included: form 1040, form 2441, form 8867, form 1040x lient’s..

Attachment for TAXES 13-28, Georgia State Income Tax Withholding. Beginning with the wages paid for Pay Period 12, 2013, the National Finance Center (NFC) will make

Tax Withholding Election for Periodic Payments 1. Use this form to make your federal and any state tax If you reside in Georgia,state . tax withholding

Form 1040EZ, Income Tax Return for Withholding Payroll Tax Obligations by State Employers in states with an income tax have state payroll tax withholding

Download Free Georgia State Tax Withholding Forms. View forms, samples and spreadsheet of Georgia State Tax Withholding Forms.

Georgia Tax Information . REGISTRATION INFORMATION . GEORGIA DEPARTMENT OF REVENUE – WITHHOLDING TAX . State W -4 (form G-4) is available, and REQUIRED.

Georgia income tax return last year and the amount on Line 4 of Form 500EZ or Line 16 of Form 500 was zero, and you expect to file a Georgia tax return this year and will not have a tax liability. You can not claim exempt if you did not file a Georgia income tax return for the previous tax year. Receiving a

Georgia Taxes news & advice on filing taxes and the latest tax forms, rates, exemptions & laws in GA.

EMPLOYER/PAYER STATE WITHHOLDING ID3. Georgia Form. 500. I. ndividual Income Tax Return. Georgia Department of Revenue Saving the Cure Fund

SECTION 1 RETIREE INFORMATION – Georgia

F11329-GA (3/11) Page 1 of 1 GEORGIA STATE INCOME TAX Withholding Election Form I want the following percentage withheld from the taxable portion of each payment:

2018-03-01 · Request for Transcript of Tax Return. Normal . Form W-4. Employee’s Withholding Allowance Certificate. Form 941. Georgia State Website.

Signature Date > > > GEORGIA State Income Tax Withholding Election Notice for Qualified Periodic and Non-Periodic Pension and Annuity Payments Withholding of Georgia

state of georgia employee’s withholding allowance certificate. have a Georgia income tax liability this year. If necessary, mail form to: Georgia Department of Revenue, Withholding Tax Unit, P.O. Box 49432, Atlanta, GA controller.nd.edu

STATE OF GEORGIA WITHHOLDING CERTIFICATE FOR because the standard deduction is built into the Georgia withholding tax Form G4-P, Withholding for Pensions

Georgia Forms. Overview: To find Form G-4 State Employee’s Withholding Allowance Certificate. Sales and Use Tax Report Form. ST-5 Georgia Dealer or Purchaser

GEORGIA TAX TABLES, Tax Year: 2017; Georgia Federal and State Income Tax Rate

Get form info, due dates, reminders & filing history for Georgia GA-V: GA Withholding Payment Voucher

2009-10-21 · If you happen to live in Georgia, then you will need Georgia state tax forms in order to complete your state income taxes. Category Howto & Style; – free download seventh day adventist church manual State of Georgia Employee’s Withholding Allowance Certificate. Complete this form and give it to your employer so state tax is withheld.

The Georgia Department of Revenue for withholding Georgia state income taxes from Form G-7, Withholding Return is used when you [Georgia] State Payroll Taxes;

… (all local taxes reported on state income tax form): Missouri in 1865, Georgia in 1866, U.S. State Non-resident Withholding Tax; State Sales Tax; Notes

State Accounting Office. Fiscal Leadership for Georgia. Uniform State Codes; Georgia Revenues and Reserves; G-4 State Tax Withholding Form

State Tax Forms Simply click on the state, download the State Tax Form and submit it to Payroll – Mail Code 0435. Federal Tax Withholding Calculator; Understanding Your W2; Notes: Georgia Tech is not registered in every state. Income tax is withheld in the state where you live and work.

The Georgia income tax has six tax brackets, with a maximum marginal income tax of 6.00% as of 2018. Detailed Georgia state income tax rates and brackets are

Fill Fillable Ga State Withholding Form, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile with PDFfiller Instantly No

Atlanta Real Estate Lawyer explains Georgia Withholding Tax for Sale of Georgia Property by Non-Residents.

Georgia State Tax Form G-4 Instructions STATE OF GEORGIA EMPLOYEE’S WITHHOLDING ALLOWANCE CITY, STATE AND ZIP CODE If necessary, mail form to: Georgia Department of

Georgia State Income Tax Withholding Form Find Georgia form 500 instructions at eSmart Tax today. E-file your state and federal tax returns with us and receive the

State of Georgia Employees Withholding Allowance Certificate Complete this form and give it to your employer so state tax is withheldComplete Form W4 so that your

F11329-GA state tax 3-7-11 tiaa.org

Form G-4 State Of Georgia Employee’S Withholding

Download Georgia State Tax Withholding Forms for Free

Georgia Internal Revenue Service

State Tax Withholding Forms Forward Air

560-7-8-.34 Withholding on Nonresident Members of

Department Of Revenue Forms State Tax Form Georgia 2018

Georgia State Tax Form G-4 Instructions WordPress.com

– Georgia’s New Withholding Rules

Georgia Withholding Payment Voucher (GA-V) Tax Reminder

” Georgia State Withholding Tax Form PDF documents

Georgia New Employer Information Patriot Software

GEORGIA TAX TABLES Georgia state withholding 2017

GEORGIA TAX TABLES Georgia state withholding 2018

Atlanta Real Estate Lawyer explains Georgia Withholding Tax for Sale of Georgia Property by Non-Residents.

Use SmartAsset’s Georgia paycheck calculator to calculate your state, and local taxes. The IRS has since released updated tax withholding guidelines and

fillable ga state withholding form ga state witholding forms online fillable and printable georgia g4 form fillable state of georgia employee withholding georgia withholding tax form g 4p georgia state tax form w 4 fillable georgia state withholding form fillable

Filing the Georgia state tax varieties 2014 online is quite straightforward as the internet sites offer action-by-step recommendations. This approach of Georgia point

Attachment for TAXES 13-28, Georgia State Income Tax Withholding. Beginning with the wages paid for Pay Period 12, 2013, the National Finance Center (NFC) will make

Get form info, due dates, reminders & filing history for Georgia GA-V: GA Withholding Payment Voucher

Download Free Georgia State Tax Withholding Forms. View forms, samples and spreadsheet of Georgia State Tax Withholding Forms.

Georgia new employer information on how to register with the state of Georgia, and federal government, GA new employer SUTA rate, tax forms and more!

form g-4 (rev. 12/09) state of georgia employee’s withholding allowance certificate 1a. your full name 1b. your social security number 2a. home address (number

SECTION 1 – RETIREE INFORMATION STATE INCOME TAX. Substitute Form G-4P. Withholding Certificate for (as defined by provisions in the Georgia Income Tax

State Tax Forms Simply click on the state, download the State Tax Form and submit it to Payroll – Mail Code 0435. Federal Tax Withholding Calculator; Understanding Your W2; Notes: Georgia Tech is not registered in every state. Income tax is withheld in the state where you live and work.

The Georgia Department of Revenue for withholding Georgia state income taxes from Form G-7, Withholding Return is used when you [Georgia] State Payroll Taxes;

Tax Withholding Election for Periodic Payments 1. Use this form to make your federal and any state tax If you reside in Georgia,state . tax withholding

state tax form georgia 2018 As part of the Department of Revenue effort to protect Georgia taxpayers from tax fraud, georgia state income tax withholding form.

STATE OF GEORGIA EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE