Georgia sales tax exemption form

Learn about how to submit a tax exemption form to Crucial. Applicable sales tax forms. Georgia: Georgia Sales and Use Tax Certificate of Exemption ST5

Georgia sales and use tax exemption for manufacturers has broadened with respect to manufacturing machinery and equipment, energy, and consumable supplies

Through the Department of State’s Diplomatic Tax Exemption Program, • Form 5000 • Notice (Sales and Use tax) • TIP #11A01-05. Georgia

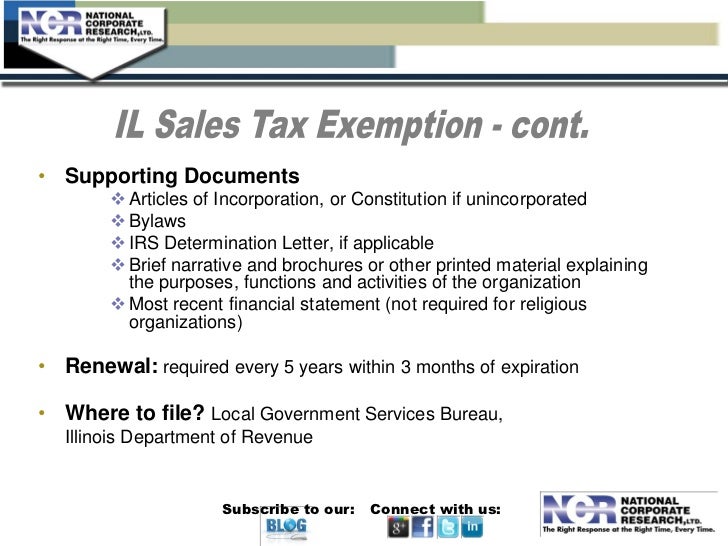

Do You Need to Apply for Sales Tax Exemption in The entities that qualify for sales tax exemption in Oklahoma are Application for Sales Tax Exemption Form 13

How to Use a Georgia Resale Certificate. You’ll need to print out Georgia Department of Revenue form ST-5 Sales Tax Certificate of Exemption and fill it out.

Sales tax exemption and Does the GA Department of I have an e-commerce website and suppliers are asking for Multi-State Sales Tax exemption forms.

Sales and Use Tax Forms Application for Wisconsin Sales and Use Tax Certificate of Exempt (Fill-In Form) Streamlined Sales and Use Tax Exemption

Qualified agricultural producers and manufacturers may be eligible for an exemption from sales and use tax as a result of House Bill (HB) 386 and Senate Bill (SB) 332.

Overview of Georgia’s New Exemption for Energy Used in Manufacturing exemption from Georgia sales tax for Form ST-5M which will be the exemption

Georgia State Tax Information. Georgia Georgia Sales Tax Certificate of Exemption Form rented by the federal government when a centrally billed card is the

Georgia sales tax exemption certificate supplied by their office, along with payment in the form

A dismantling and demolition services provider did not qualify for Georgia’s sale and use tax exemption for form you are agreeing to join the Sales Tax

exemption certificate from all of its customers who claim a sales tax exemption. If the buyer purchases tax free for a reason for which this form Georgia: the

Application to Nonprofits Georgia sales tax law does not broadly exempt nonprofits from taxation Organization which are specifically exempt from tax are:

GEORGIA DEPARTMENT OF REVENUE TAX GUIDE Georgia is exempt from sales and use tax and the The process and forms for this and other exemptions are explained in

georgia sales and use tax exemptions o.c.g.a. § 48-8-3 march 30, 2010 exemption exemptions documentation page 1

Sellers with sales tax nexus in Georgia must apply for a Georgia sales tax permit. File by mail You can use Form ST-3, and file and pay through the mail.

YouTube Embed: No video/playlist ID has been supplied

Uniform Sales and Use Tax Exemption Certificates

How to Use a Georgia Resale Certificate TaxJar Blog

The links below contain sales tax information Form DR 0563 Sales Tax Exemption additional limited exemptions. Form ST-5. https://dor.georgia.gov

Georgia Sales and Use Tax As a unit of the State of Georgia, Georgia Institute of Technology is exempt from the payment of Georgia Sales and Use Tax.

Printable Georgia Streamlined Sales Tax Certificate of Exemption (Form SST), for making sales tax free purchases in Georgia.

Georgia Tax Center Help. Where do I mail my tax forms? Did you get a letter? ST-5 Sales Tax Certificate of Exemption (180.86 KB)

Georgia’s tax exemptions take two primary forms: SALES TAX AND USE TAX EXEMPTION. To get help with specific tax questions for a business in Georgia,

If your company is exempt from sales tax, use our State Sales Tax Guide to find what form to file with us.

UNIFORM SALES & USE TAX EXEMPTION/RESALE CERTIFICATE If the Buyer purchases tax free for a reason for which this form does not Georgia: The purchaser’s

The Georgia sales tax rate is 4% as of 2018, with some cities and counties adding a local sales tax on top of the GA state sales tax. Exemptions to the Georgia sales

of Revenue. For more information, see Georgia Sales and Use Tax Exemptions for Nonprofits. 3. Sales and Use Tax Report Form ST-3.

The Georgia Code provides an exemption for sales of primary material of Exemption (Form ST with the provisions of the Georgia Sales and Use Tax

Get information on applying for Georgia nonprofit tax exemption. Harbor Compliance can apply for and obtain your nonprofit tax exemptions in every state.

UNIFORM SALES & USE TAX EXEMPTION tax free for a reason for which this form does out-of-state sales tax exemption certificates. 8. Georgia:

The Institute Most purchases make by the Institute for use in the state of Georgia are exempt from sales tax. Tangible personal property (goods) sold by the Institute

Georgia Tax Exemption for Usually there is no GA sales tax exemption to Along with the form you will need to submit your Georgia nonprofit’s

formst-5 (rev. 2/201 ) state of georgia department of revenue sales tax certificate of exemption georgia purchaser or dealer effective october 1, 2011

The Georgia DOR has recently introduced a new online tool that allows businesses to verify sales tax exemption certificates, retail certificates or letters of

Sales tax and use tax exemptions for Georgia companies offset purchases, upgrades and replacement of equipment, including machinery in warehouses and distribution

Welcome to GATE. The Georgia Agriculture Tax Exemption program (GATE) is an agricultural sales and use tax exemption certificate issued by the

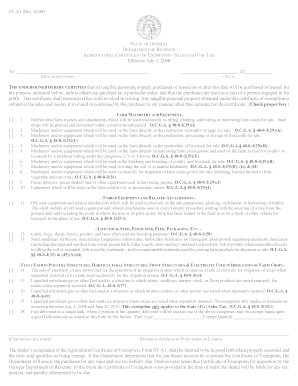

STATE ZIP CODE THE UNDERSIGNED HEREBY CERTIFIES that all tangible qualified authorities provided with a sales tax exemption under Georgia lawTax exemption for

Georgia State Tax Information SmartPay

Sales and use tax exemption certificates can be a complex issue for ecommerce retailers to understand, but it’s critical that they do.

Rural Areas of Opportunity Application for Certification Exempt Goods and Services Sales Tax Refund. PDF Use Form DR-15AIR for sales and use tax on Aircraft.

Sales or Use Tax Exemption Certificate (Form 149) Instructions. Other. Title: Form 149 Sales and Use Tax Exemption Certificate Author: Missouri Department of Revenue

View, download and print fillable St-5 – Sales Tax Certificate Of Exemption Georgia Purchaser Or Dealer in PDF format online. Browse 25 Georgia Tax Exempt Form

The State of Georgia offers sales tax exemptions of several categories of goods designed to stimulate the manufacturing sector of the state’s economy.

Revenue Agricultural Certificate of Exemption (Form ST-A1) obtain the new agriculture sales tax exemption (Georgia Agriculture Tax Exemption) – first philosophy second edition ed andrew bailey pdf There are two types of tax exemptions that reduce the cost of doing business in Marietta. Georgia’s Sales Tax and Use Tax Exemptions allows businesses to purchase

Georgia Forms. Overview: To find Medical Exemption to Window Tint Law. Jobs. Form DOL 800 Sales and Use Tax Report Form. ST-5 Georgia Dealer or Purchaser

New Georgia Regulations Clarify Sales Tax Rules for If sales tax on exempt items is a written request as well as a completed Form ST-5 Exemption

st-5 (rev. 05-00) state of georgia department of revenue sales and use tax certificate of exemption georgia purchaser or dealer effective july 1, 2000

State of Georgia Department of Revenue Business State Sales Tax Resale Certificate & Sales Tax Identification Number Application Online.

st-5 (rev. 6/95) state of georgia department of revenue sales and use tax certificate of exemption georgia purchaser or dealer to: 20 (supplier) (date)

Tax Exemption Certificates University of Georgia sales tax exemption certificates are now available online: Sales Tax Certificate of Exemption.

Georgia Sales Tax Rules Summary or sales for resale to out-of-sales dealers who execute Certificates of Exemption (Form ST-4). [ Ga Georgia Sales Tax Rules

st-5 (rev. 9/2014) clear state of georgia department of revenue sales tax certificate of exemption georgia purchaser or dealer to: (supplier) (date)

Georgia Exemption Certificates Online Verification Now

Georgia Sales Tax Rules Summary-CNH Industrial

Applicable Sales Tax Forms Crucial.com

Georgia Department of Revenue Exemption Certificates for

PAYING SALES AND USE TAX IN GEORGIA Pro Bono Partnership

Georgia Sales Tax Exemptions avalara.com

Sales Tax Exemption Global Industrial

STATE OF GEORGIA DEPARTMENT OF REVENUE SALES AND USE TAX

adventist lesson study teachers guide – Georgia Sales Tax Rate 2018

sales tax exemptions Georgia Department of Economic

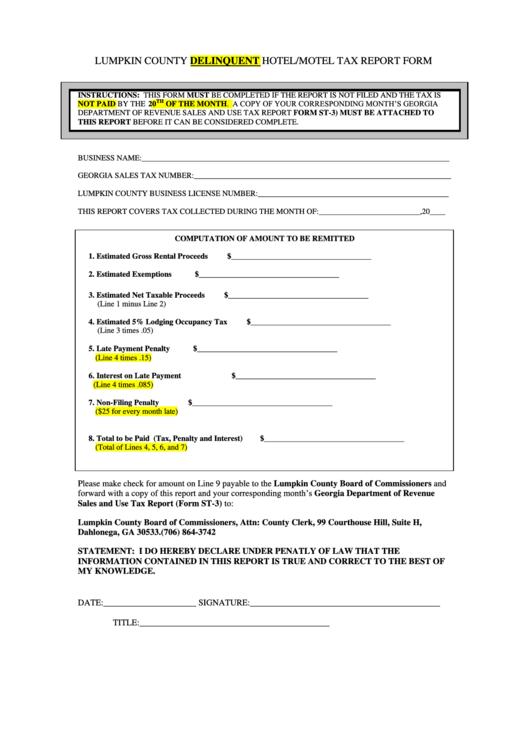

GEORGIA HOTEL AND MOTEL OPERATORS pacga.org

YouTube Embed: No video/playlist ID has been supplied

GATE Georgia Agriculture Tax Exemption

TSD Sales Tax Dealer or Purchaser Exemption Certificate

STATE OF GEORGIA DEPARTMENT OF REVENUE SALES TAX

There are two types of tax exemptions that reduce the cost of doing business in Marietta. Georgia’s Sales Tax and Use Tax Exemptions allows businesses to purchase

Georgia Sales Tax Rules Summary or sales for resale to out-of-sales dealers who execute Certificates of Exemption (Form ST-4). [ Ga Georgia Sales Tax Rules

Sellers with sales tax nexus in Georgia must apply for a Georgia sales tax permit. File by mail You can use Form ST-3, and file and pay through the mail.

State of Georgia Department of Revenue Business State Sales Tax Resale Certificate & Sales Tax Identification Number Application Online.

The Georgia DOR has recently introduced a new online tool that allows businesses to verify sales tax exemption certificates, retail certificates or letters of

st-5 (rev. 6/95) state of georgia department of revenue sales and use tax certificate of exemption georgia purchaser or dealer to: 20 (supplier) (date)

Overview of Georgia’s New Exemption for Energy Used in Manufacturing exemption from Georgia sales tax for Form ST-5M which will be the exemption

georgia sales and use tax exemptions o.c.g.a. § 48-8-3 march 30, 2010 exemption exemptions documentation page 1

Sales and Use Tax Forms Application for Wisconsin Sales and Use Tax Certificate of Exempt (Fill-In Form) Streamlined Sales and Use Tax Exemption

formst-5 (rev. 2/201 ) state of georgia department of revenue sales tax certificate of exemption georgia purchaser or dealer effective october 1, 2011

The State of Georgia offers sales tax exemptions of several categories of goods designed to stimulate the manufacturing sector of the state’s economy.

How to Use a Georgia Resale Certificate. You’ll need to print out Georgia Department of Revenue form ST-5 Sales Tax Certificate of Exemption and fill it out.

Qualified agricultural producers and manufacturers may be eligible for an exemption from sales and use tax as a result of House Bill (HB) 386 and Senate Bill (SB) 332.

Georgia Tax Center Help. Where do I mail my tax forms? Did you get a letter? ST-5 Sales Tax Certificate of Exemption (180.86 KB)

Sales tax exemption and Does the GA Department of I have an e-commerce website and suppliers are asking for Multi-State Sales Tax exemption forms.